CAM reconciliation in real estate is a way to determine the maintenance costs and operating expenses. This is specifically for common areas on a property to all tenants. A CAM reconciliation statement is a report that outlines the CAM expenses that were incurred during a given period.

CAM expenses can include a number of charges. As a property owner or manager, you will want to ensure tenants pay for the upkeep of shared areas in commercial properties, like parking lots, lobbies, and elevators.

This is why property owners issue tenants a reconciliation statement to seek CAM reconciliation, enabling them to collect funds for CAM expenses. This period is usually for one year, but it will depend on the lease agreement.

Commercial real estate CAM reconciliation processes might be familiar if you are a Commercial Real Estate property owner or manager.

Accurate budgeting and calculation of CAM expenses can help you to prevent any disagreements with tenants. Because a report must detailed, it should clearly show how the CAM fees are calculated.

This leaves no room for doubt as to who should be paying for expenses. CAM reconciliation can help you identify any discrepancies or mistakes in CAM expenses, which can be resolved before the next reconciliation cycle.

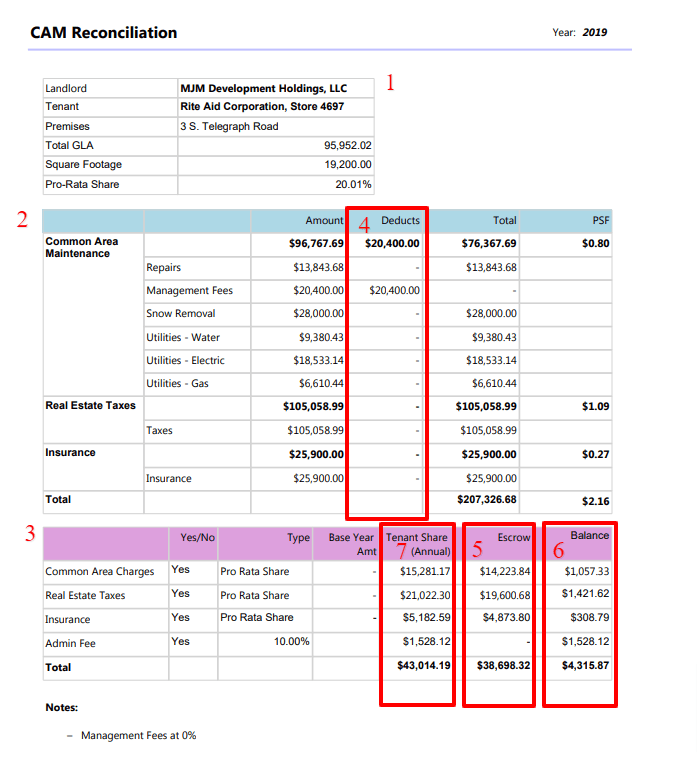

We’ve broken down the CAM reconciliation statement into seven parts. Let’s dig deeper into each one and explain the meaning behind it.

1. Tenant Information

The tenant information section contains the Landlord and Tenant Names. The section also contains information about the total property size and tenant’s space size. The Tenant’s pro-rata share is what drives most of the calculations on the CAM Reconciliation Statement.

2. Annual Property Expenses

This section represents the actual property expenses for the selected calendar year. The expenses are grouped by category in the CAM reconciliation statement. In addition, they are separated by three main groups which are Common Area Maintenance or CAM, Real Estate Taxes, and Insurance.

3. Tenant Dues/Escrow

The tenant dues/escrow section displays what the Tenant’s annual share of CAM, Property Taxes and Insurance are based on Tenant’s pro-rata share as well as the actual expenses. The calculations in this section take into account Tenant’s pro-rata share as well as the properties annual expenses. This section also groups by CAM, real estate taxes, and insurance.

4. Deductions

The deductions column on the Annual Property Expenses section displays any specific deductions the tenant has under their Lease. Certain Commercial Real Estate leases provide for caps, limits or exclusions on certain categories. It’s not uncommon for a Tenant to exclude management fees or limit repairs or capital improvements. These exclusions and limits are defined in the lease and can be set up in UnitConnect under the Rent Details page. The total property expenses are then adjusted while taking all deductions for the tenant into consideration.

5. Escrow

In the CAM reconciliation example statement, there is a Tenant escrow column in the Tenant Escrow/Dues section. It shows how much the Landlord or Manager has collected from Tenant for the given calendar year. Based on majority of the leases, many tenants pay an estimated amount of CAM fees, Tax and Insurance monthly on top of their base rent. The amount collected during the year is considered an escrow. The escrow amounts are also summarized based on the group.

6. Balance

The Tenant balance is a simple calculation of what the tenant owes minus what the Tenant has in escrow. The balances are summarized by group in the CAM reconciliation statement.

7. Tenant Share

The Tenant share is the calculation of Tenant’s share of Annual expenses for Common Area Maintenance, Taxes, and Insurance. The total expenses are multiplied by Tenant’s pro-rata share.

A sample report provided by UnitConnect

Save Time and Potential Delays for CAM Reconciliation

In summary, the CAM reconciliation statement is something that should be provided to your tenant on an annual basis. Many Leases actually require Landlord or Property manager to submit a CAM Reconciliation Statement to the Tenant within a certain period.

Providing a concise and easy to follow report alleviates a lot of headaches and delays for payment. Having a straightforward report makes it easier for tenants to understand what they are pay for in CAM fees. This eliminates doubt and ensures transparency.

Furthermore, having this information readily available in UnitConnect typically eliminates countless hours of putting together this report. Running a report for the entire property takes only a few clicks!

It shouldn’t take hours for you to create a CAM reconciliation spreadsheet to handle your reports. With UnitConnect, our software provides a standard and easy-to-understand CAM reconciliation template.

Give UnitConnect a try and see how easy it really is to generate a CAM Reconciliation Statement.